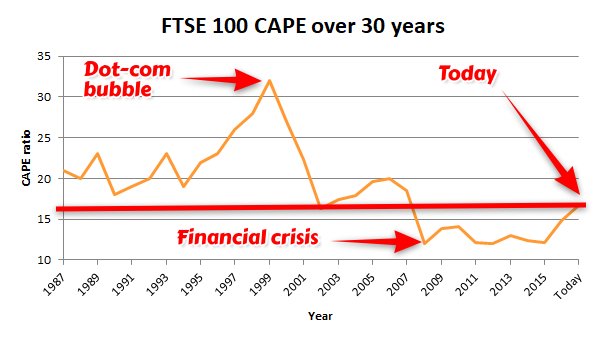

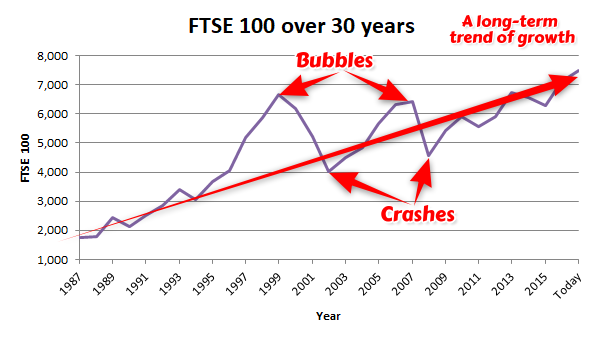

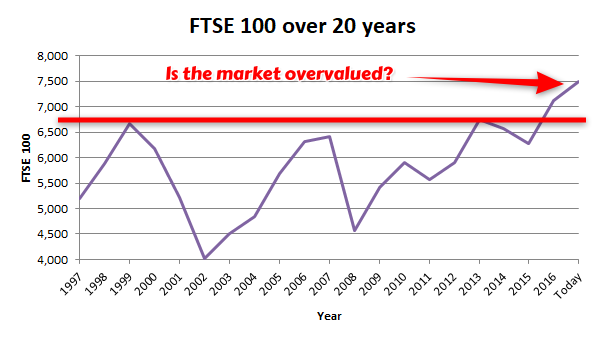

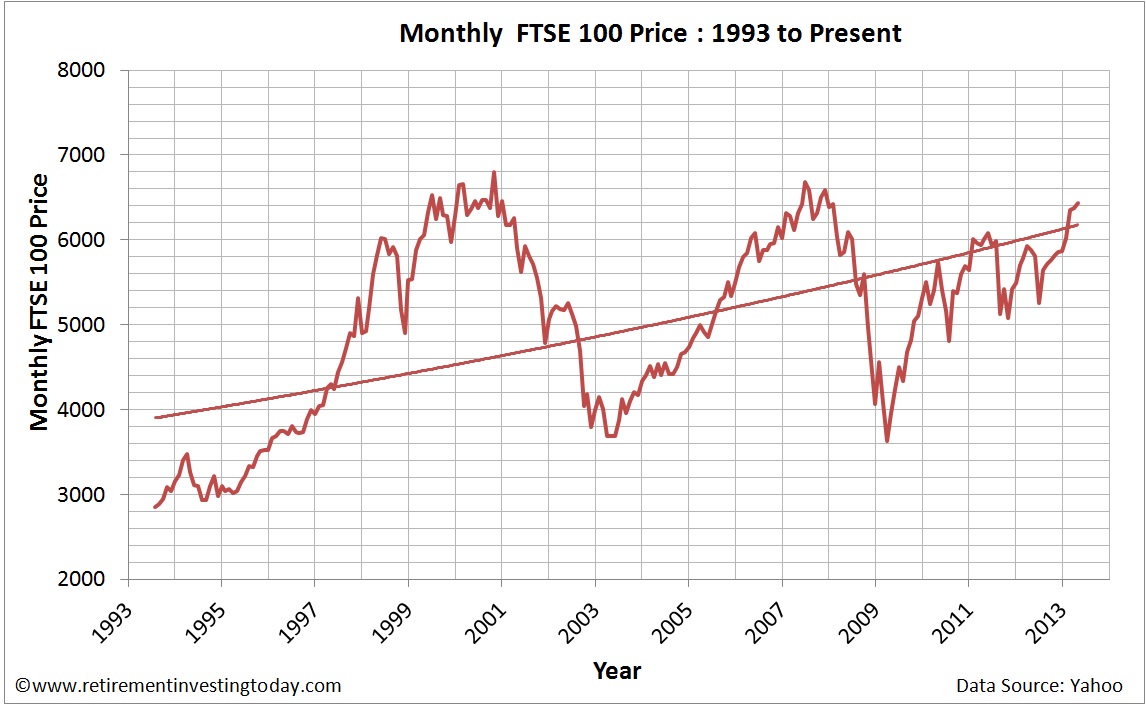

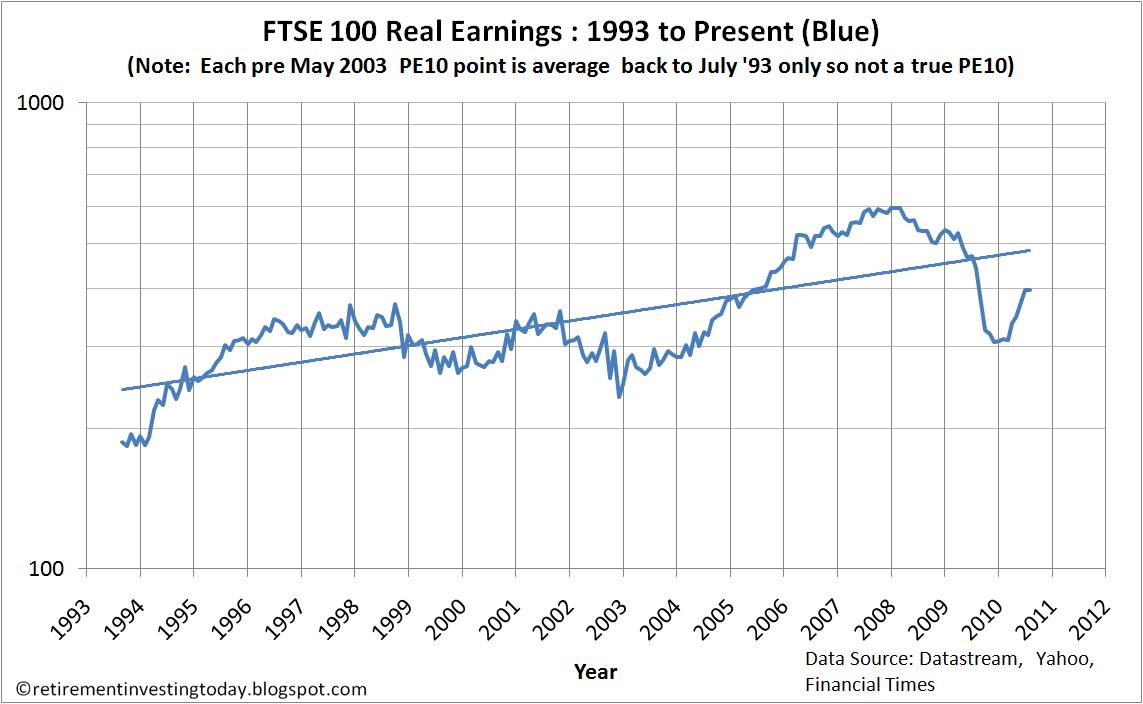

Retirement Investing Today: The FTSE 100 cyclically adjusted PE ratio (FTSE 100 CAPE or PE10) – May 2011

Retirement Investing Today: The New FTSE 100 Cyclically Adjusted Price Earnings Ratio (FTSE 100 CAPE) Update - April 2013

Retirement Investing Today: UK FTSE 100 CAPE or FTSE PE10 based on the Shiller cyclically adjusted price earnings ratio model