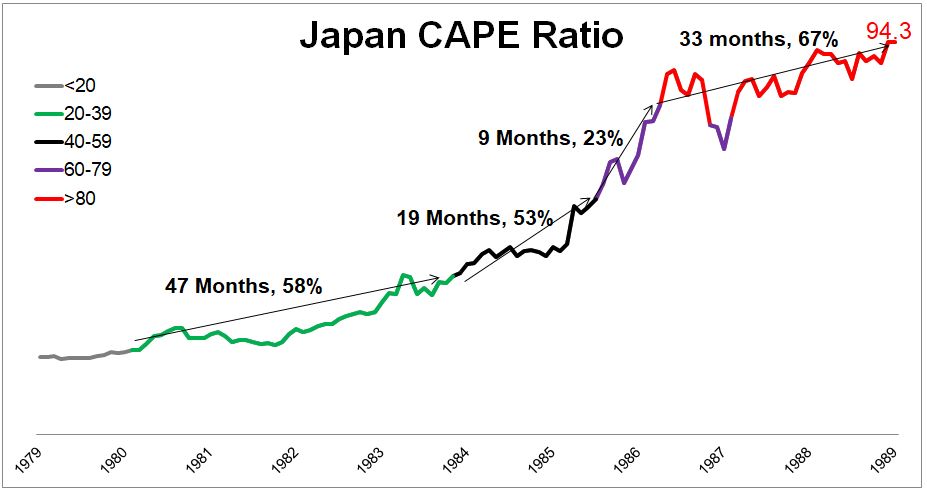

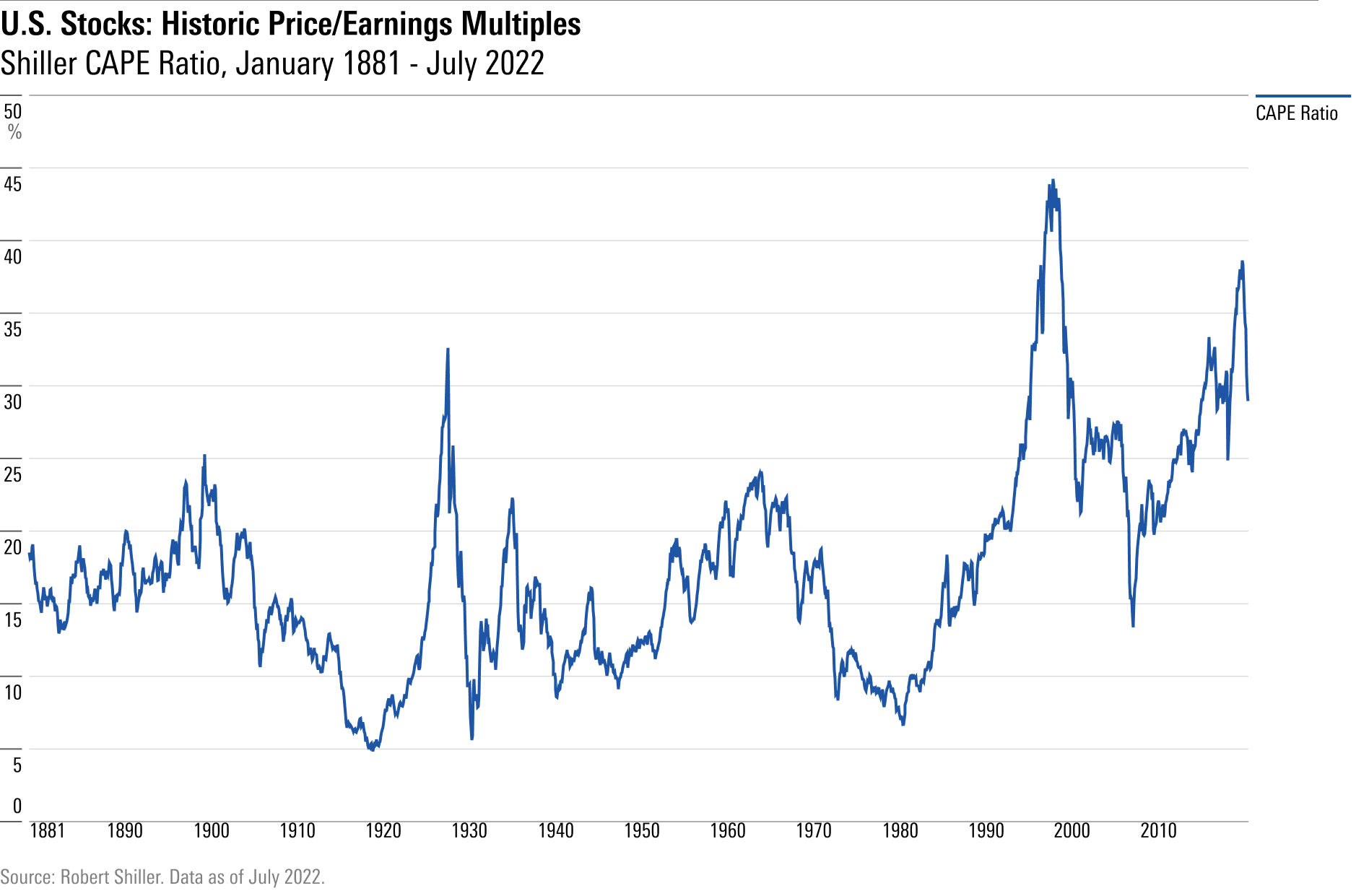

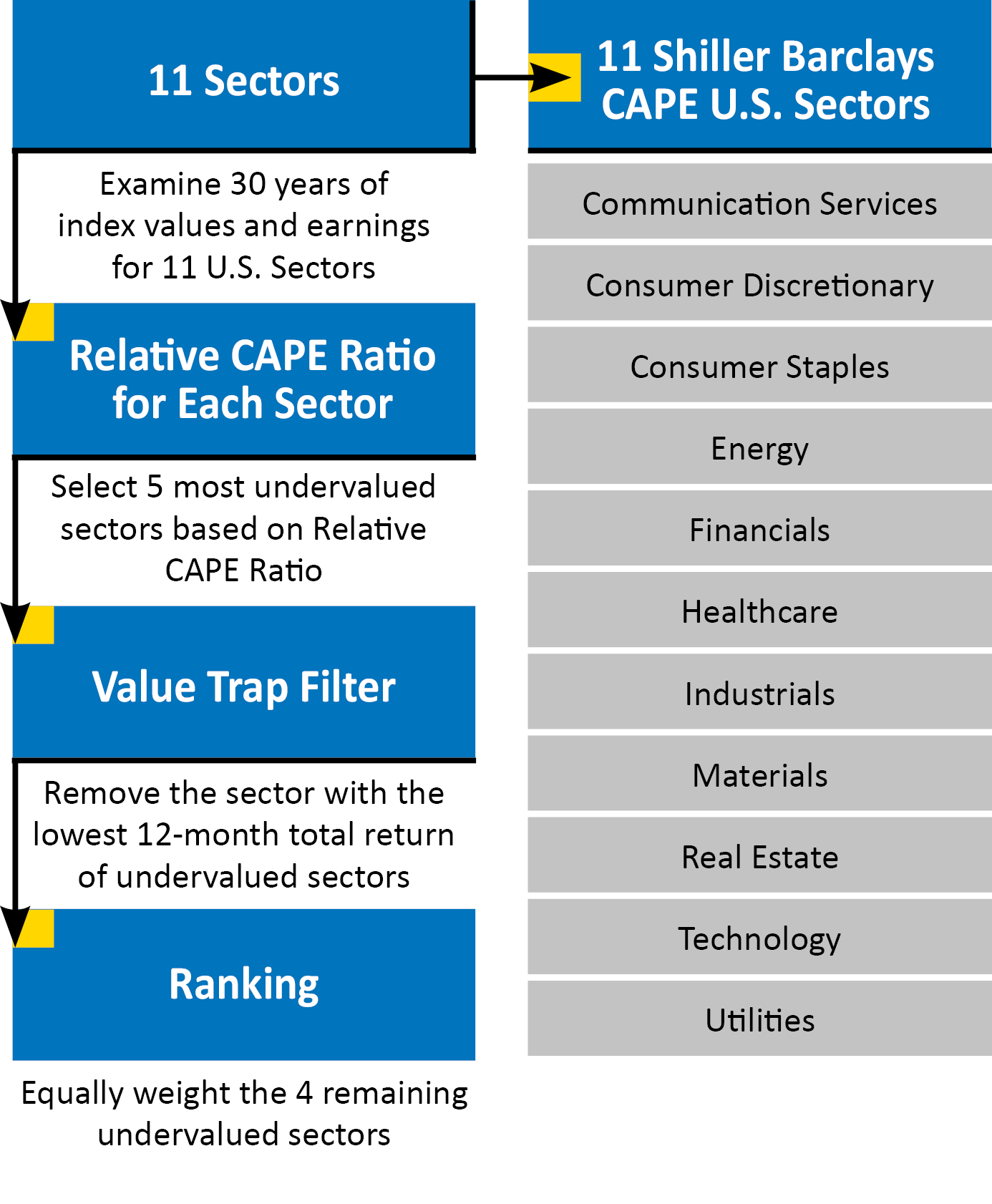

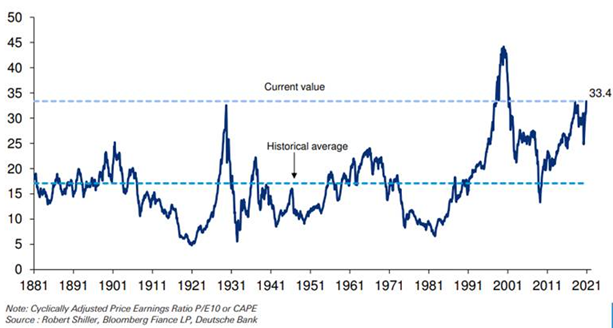

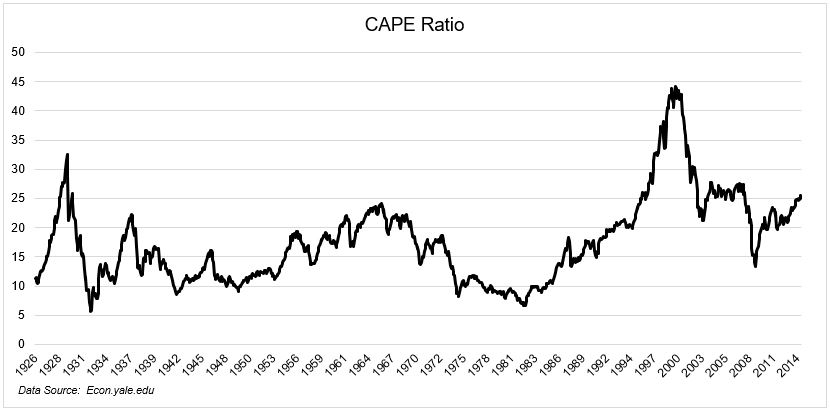

New global research on Graham / Shiller Cyclically Adjusted Price Earnings ( CAPE) ratio | Greenbackd

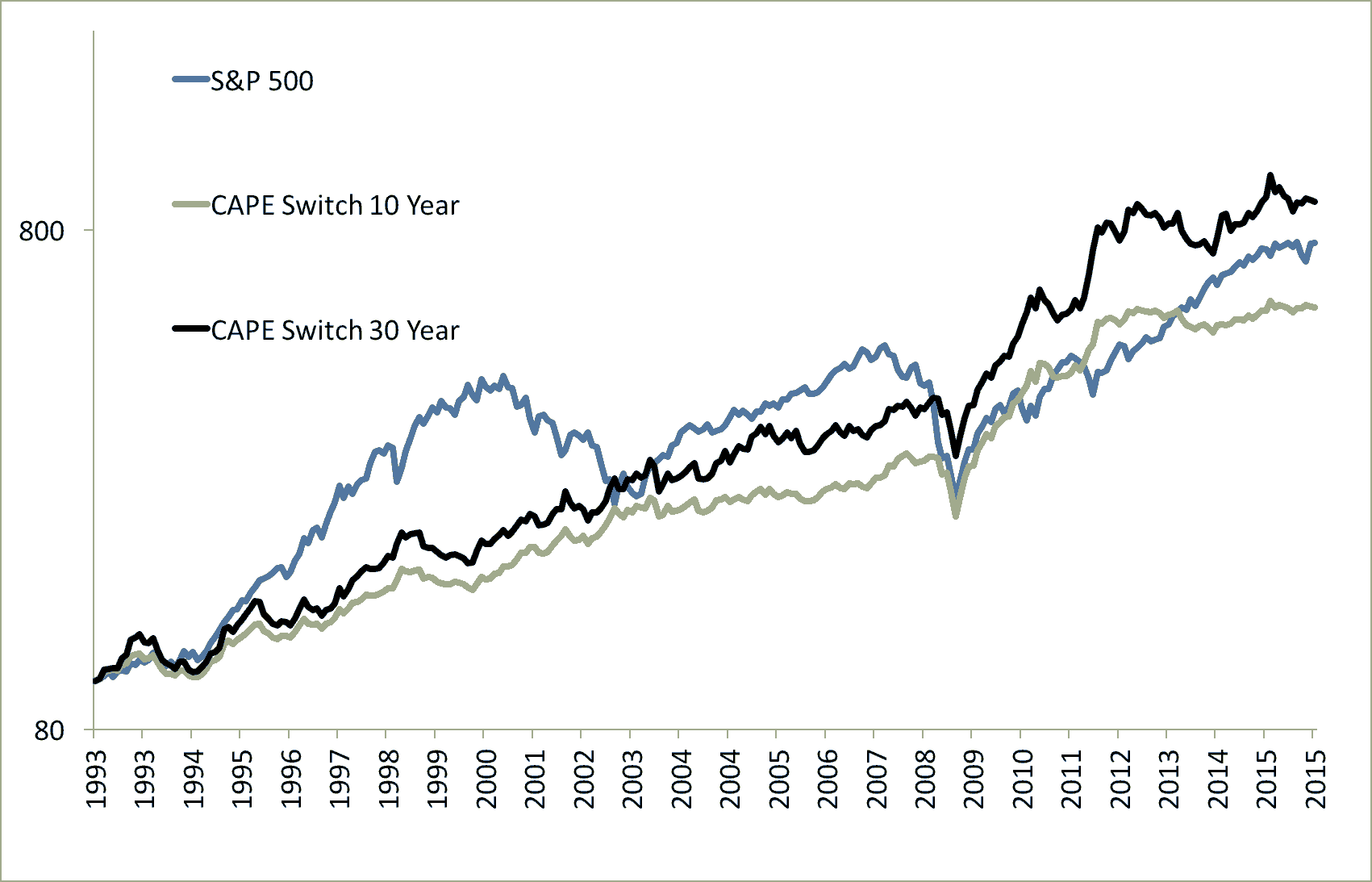

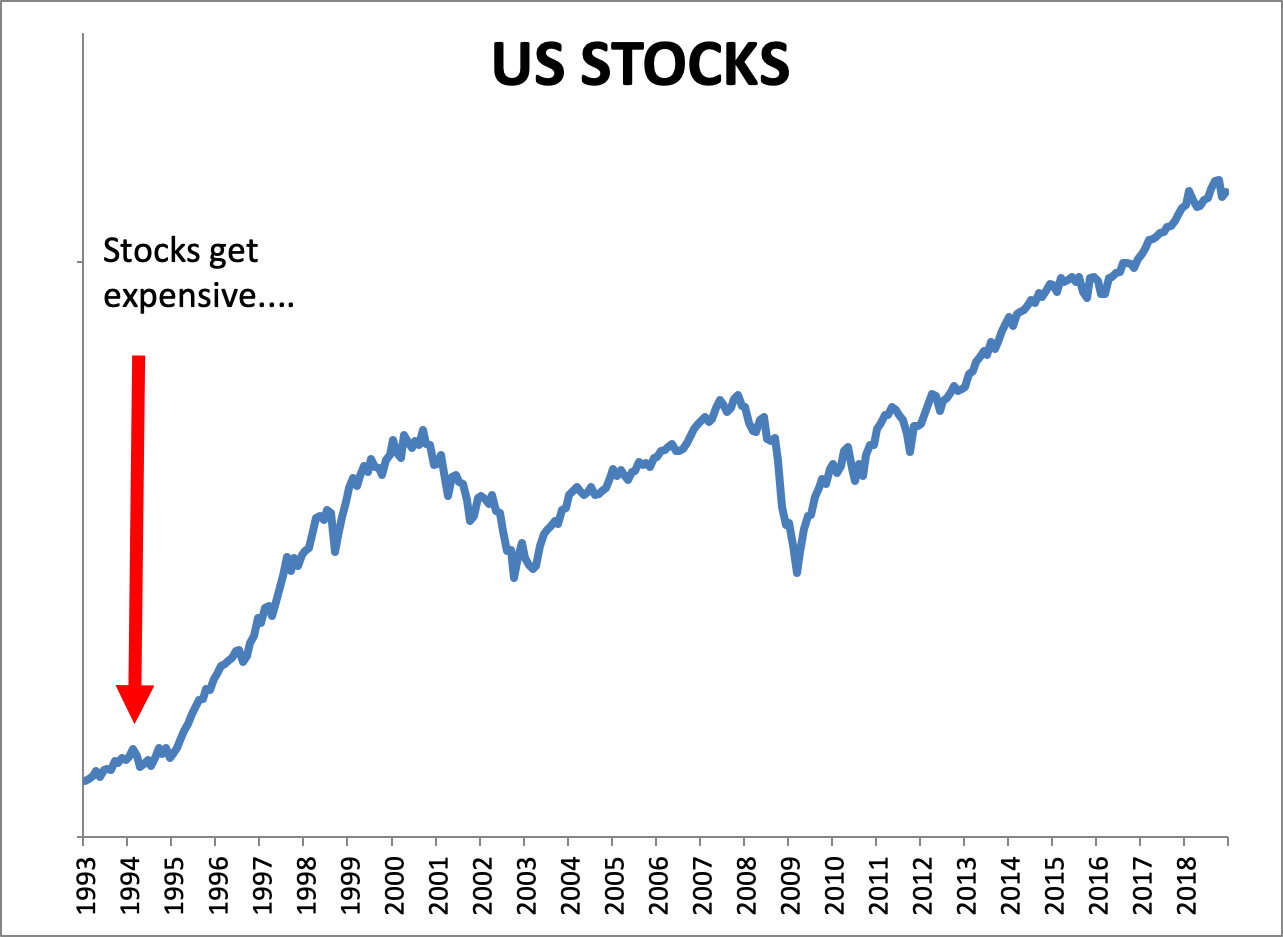

You Would Have Missed 961% In Gains Using The CAPE Ratio, And That's A Good Thing - Meb Faber Research - Stock Market and Investing Blog

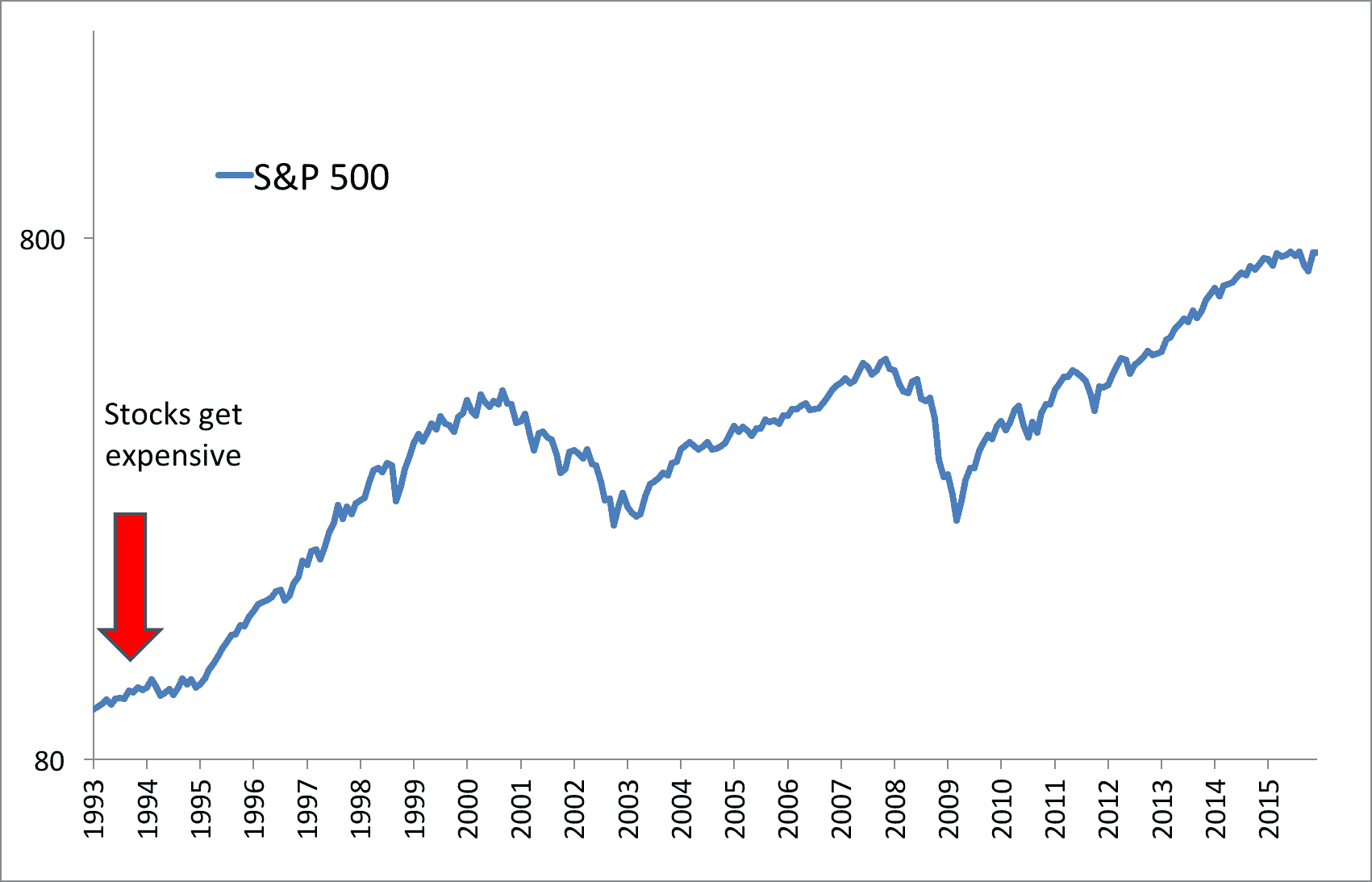

You Would Have Missed 780% In Gains Using The CAPE Ratio, And That's A Good Thing - Meb Faber Research - Stock Market and Investing Blog

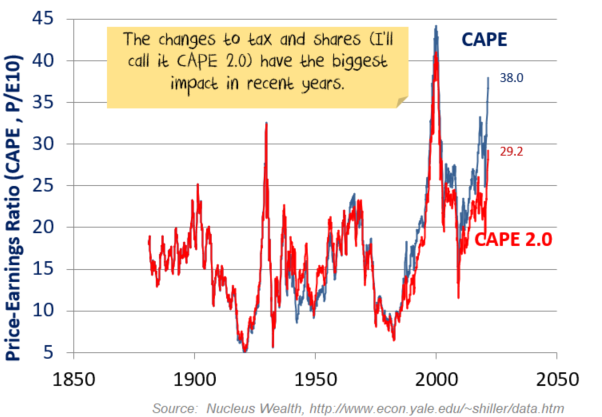

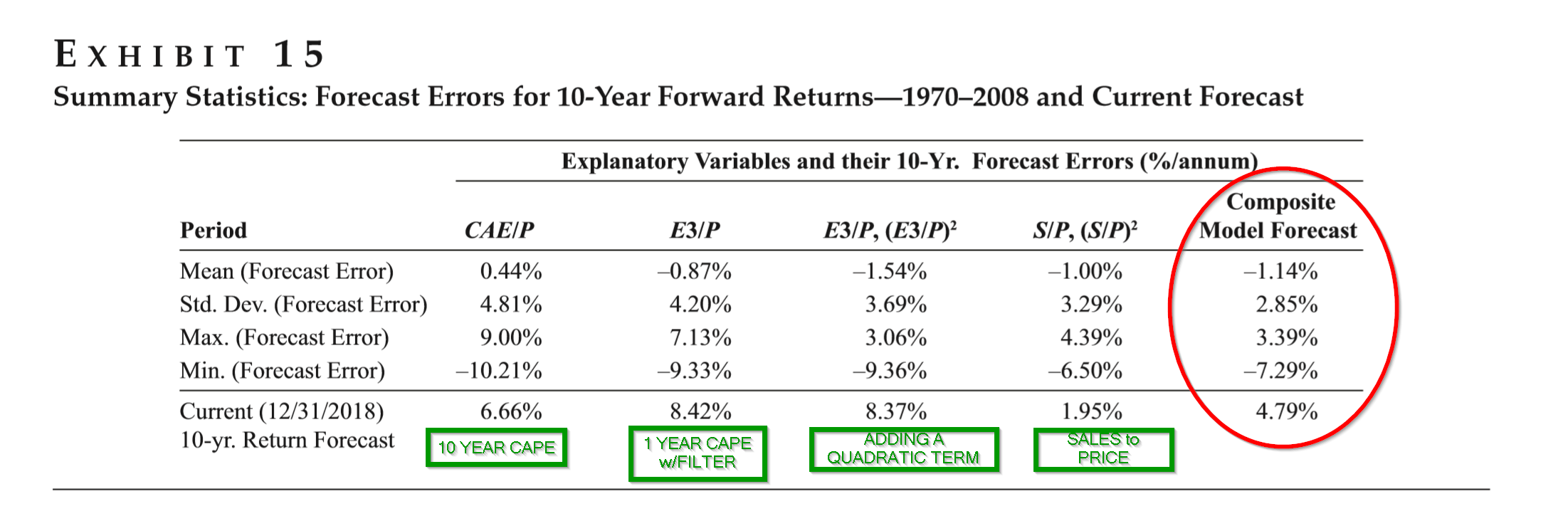

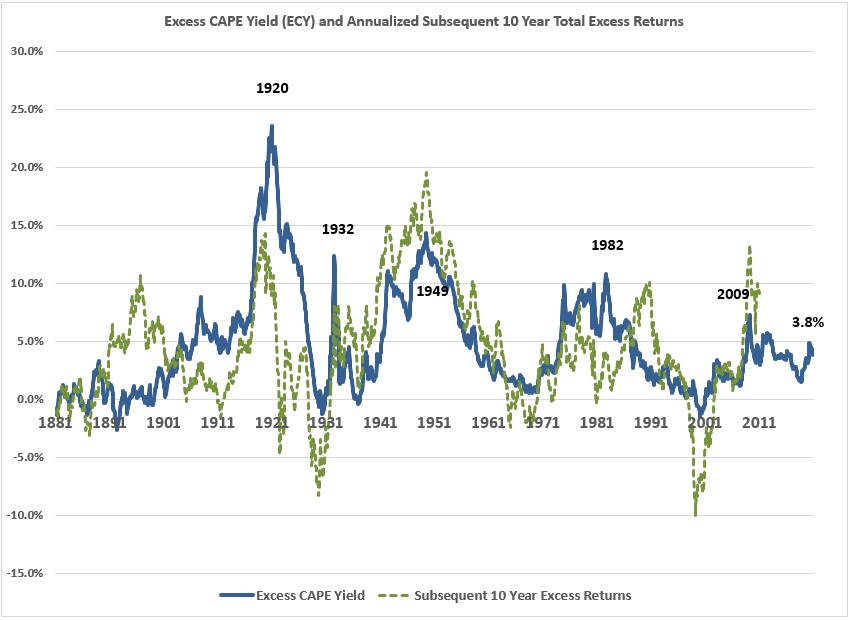

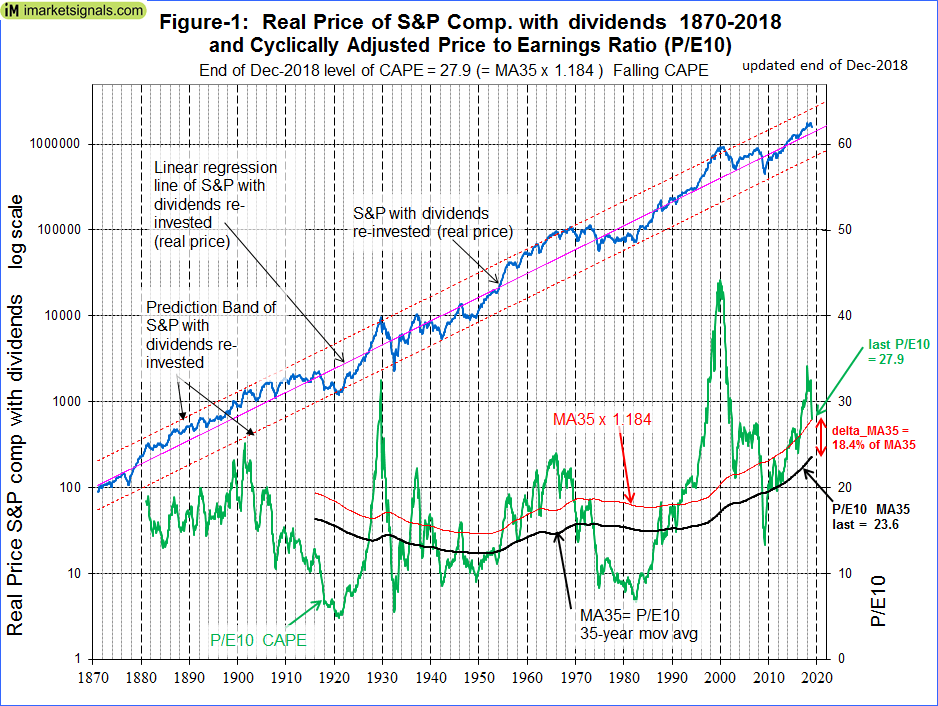

Estimating Forward 10-Year Stock Market Returns Using The Shiller CAPE Ratio And Its 35-Year Moving Average - Update December 2018 | Seeking Alpha

New global research on Graham / Shiller Cyclically Adjusted Price Earnings ( CAPE) ratio | Greenbackd